It starts with a Plain or Masala Dosa. But ends with something like Cheese-Butter-Masala-Mysore-Paneer-Chocolate-Baby Corn Dosa. Is there any reason for Saving Account options to resemble a dosa menu?

How many Netflix subscriptions can you choose from?

Maybe 2.

Hotstar plans? At best 4.

Amazon Prime? Again 2.

Take a different segment. Microsoft Office subscription options — maybe 5.

Telecom plans: Slightly more, probably 6.

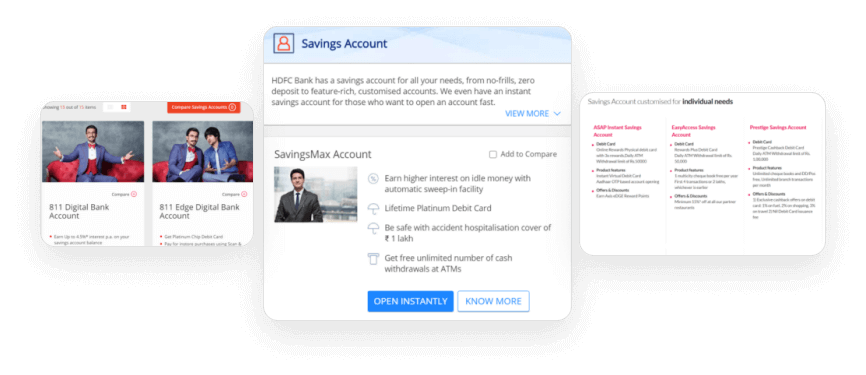

But look at the Savings Account options for Kotak Bank, or Axis Bank or HDFC Bank. Most average bank easily have 15+ Savings Account option. One top shot bank goes up to 50 Savings Account options (Must have been an annual Sales Meet high that year!). In fact, SBI has the least number of savings account product at just 4.

In the age of Neobanks, this crazy labyrinthine world of Savings Account sounds completely out of sync and here is my view on what needs to be reexamined.

A simple configuration in account settings, can also allow user to unhide restaurants he may have previously hidden. (Shown above)

A simple configuration in account settings, can also allow user to unhide restaurants he may have previously hidden. (Shown above)

It’s Just A Savings Account, Stupid

That’s not a fair comparison, bankers argue.

After all, we have many different segments and multiple features to deal with. There absolutely cannot be a one size fits all. It’s the era of customized solutions.

You would think that there should be different accounts just based on the minimum balance required or minimum monthly or quarterly balance. But banks have different products based on:

1) Gender: Women’s Savings Account

2) Age: Senior Citizen’s Account and Kids account

3) Location: Rural Accounts

4) Occupation: Farmers, Professionals, Salaried

5) Linked to Loans or Special Cases: Auto Loan Savings Account, or Motor Accident Claims Account (This is enough to dissuade anyone from getting into an accident)

6) And, of course, Minimum Monthly Balance

Then comes the issue of nomenclature or branding of these accounts. Unless you were in the list of people shifting to Mars, what would a savings account called ‘Nova Savings Account’ mean to you? Or perhaps The One Savings Account (almost seems like a universal truth denoting that the money in your account is an illusion).

In most cases, the underlying difference in the Savings Account products is two things: the minimum monthly balance and the charges or limits for specific transactions. But in the craze for creating new products, these are overshadowed.

Permutation/Combination, Anyone

Bankers love the idea of having the ability to tweak variables into different products. After all, they invented exotic derivatives and junk bonds. Core banking systems have been designed to cater to this exact need — where you can easily configure few fields and voila! a new product is ready.

The other reason for these many accounts is also often SEO. Oh! People are searching for a loan for their wedding or travel — let’s create a loan product to cater to these set of people. And in many cases, it is just sales opportunism. Customer seeks a home loan — let’s create a home-loan based savings account to just service this account without understanding the well that the bank is digging itself into.

Decouple Features not Accounts

Now, just for a moment imagine if Netflix were to follow a similar strategy: Different plans for women, senior citizens, urban and rural. Or different plans based on language (South Indian languages have different pricing than say Hindi or English) or maybe based on which channels are watched. [Hey, the last one does sound familiar — — many of our broadcasters did come up with such combo plans once TRAI decoupled channel pricing — and you know the mess that got us into.]

Instead what typically happens universally is that you have ONE product type, but the FEATURES can be customized or configured. For example, you can choose your languages within Hotstar.

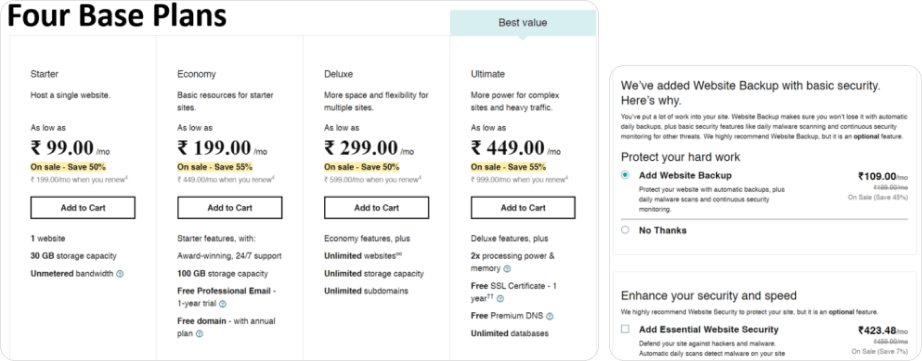

Let’s look at how other segments with so many varied sub-segments and multiple features deal with the issue. How about Website hosting and the level of customization you can do. You can configure everything from RAM, to processor speed to shared hosting to dedicated server. Yet Godaddy has 4 plans for Windows and Linux, and 4 plans for dedicated server, while still allowing for configuration of servers.

Base plan with add-ons are the way to go

Base plan with add-ons are the way to go

Building A Banking SaaS Product

Futuristic banks are already experimenting with simplifying and SaaS-ifying their banking products. Yes Bank, for instance, allows you to customize your banking account, which may not be exactly right, as it still leaves too many choices at the consumer end. N26, one of the pioneers in digital banking, has a SaaS-ified account opening in Europe with just three tiers.

Is it possible to create a similar SaaS product for India? I would dare to think so, and in my next article, I will look at a simplified 3-step approach.

Till then, enjoy your Russian salad and mayonnaise dosa!