My previous article looked at how savings account product end-up looking like a Food Court Dosa menu. Here, I take a crack at how to use the Software as a Service (SaaS) model for Savings Account in three simple steps:

Step 1: List the base features being offered

The banking features can be classified into the base features as listed below. Ideally, these base features should be free with limits that can be configured:

1) Account Balance-related: Here there will be a difference in accounts that offer zero balance to accounts that ask for minimum balance of Rs 1 lakh and more to be maintained. Accordingly, the benefits also change. But this is the primary key. Interest rates on savings account can also be linked to it. Based on minimum balance, I would recommend three types of account:

Zero Balance Account that does not come with any charges

Regular Savings Account that asks for minimum balance of Rs 10,000

Premium Savings Account that asks for minimum balance of Rs 1 lakh

2) Transaction Access: I would prefer all access modes should be available for everyone without any extra charge—whether it’s digital banking through Web or app or branch banking

3) Bill Payments: Bill payments with standing instructions can be offered to everyone

4) Bank Statements: Again, email statements or passbooks as required should be free

5) Alerts: Basic alerts for withdrawals and deposits should be free

6) Debit Card: I would prefer that this is provided free to everyone

7) Transaction Modes: This is whether the transaction is through NEFT, RTGS, IMPS, UPI, and all transactions should be free, up to the limits set.

Step 2: Specify add-on services to all account types

There are a host of features that savings account typically come with. These include:

1) Bank Lockers: Typically, paid for product based on availability. Based on account type, there can be discounts

2) Cheque Books: Generally, some minimum number of cheque leaves can be utilized every month, and there are charges for higher utilization than that

3) Cash Deposits: Based on account type, certain number of cash deposits/amount of cash deposited is free, and more than that is charged

4) Relationship Manager: Either dedicated or through call-centre based on Minimum Balance

5) Demat and Broking: Banks that have their own broking wing, generally go for a 3-in-1 account that combines savings with demat and broking

6) Insurance and Mutual Funds: Banks allow you to buy insurance or invest in insurance

7) Privileges and Offers: Banks offer certain privileges and offers—whether it’s free movie tickets, or cashbacks or dining offers. These are either limit-based or triggered on some action (set up Bill Payments and get a cashback)

8) Processing Fees: There are a host of processing fees levied—for loans, for insurance, and for certain banking transactions.

9) Financial Management or PFM Tools: Banks offer personal finance management or PFM tools that simplify your financials, help track your expenses and build your investment goals

10) Fixed Deposit Features: Many banks have come up with variations of how deposits are created. Instead of just specifying tenure and amount, you now have options to create flexible recurring deposits, or have sweep-in deposits that are linked to your savings account. None of these features by themselves are a value-add feature, and, in my humble opinion, everyone should get a sweep-in, flexible, deposit option.

Step 3: Configure Limits

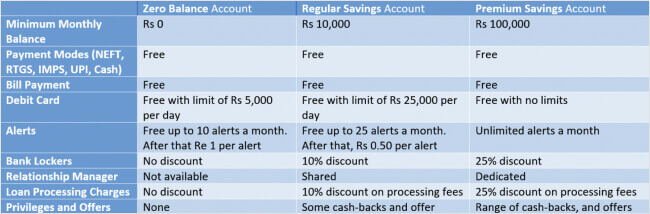

Once the feature sets and basic list is ready, limits can be configured for each service based on account type (Zero Balance, Regular, Premium). Examples could be:

1) Other Bank ATM withdrawals

- 5 for Zero Balance

- 10 for Regular

- Unlimited for Premium

2) Locker Charges

- No discount for Zero Balance

- 10% discount for Regular

- 25% discount for Premium

3) Loan Interest Rates and Processing Fees

- No discount for Zero Balance

- 25 bps reduction in interest rate for Regular Accounts and 10% discount on processing fees

- 50 bps reduction in interest rate for premium accounts and 25% discount on processing fees

4) PFM Tools

- No discount for Zero Balance Account

- 25% discount for Regular Accounts

- Free for Premium Accounts

A similar model can be created for all charge products. Once we set the limits, we create a pricing model.

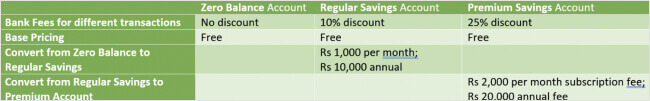

Pricing Model for Accounts

The pricing model for bank accounts can be among the following:

1) Pricing for specific add-on products or specific services or enhancing limits only on a pay per use model

2) Subscription pricing irrespective of usage for monthly/annual subscriptions

To illustrate, a SaaS table can look like this:

Table 1: Savings Account Features

Table 1: Savings Account Features

Table 2: SaaS Pricing for Savings Account

Table 2: SaaS Pricing for Savings Account

Benefits of the SaaS model for Savings Account

Apart from simplifying the whole product range and not having to invent features and pricing, there are other benefits as well such as:

1. Reducing sales effort: The sales structure in banks ends up getting split across product lines. Not just that, the sales team apart from selling the bank account also has to constantly up-sell or cross-sell. With reduced products, the sales team can be made more linear, and sales operations can be geared towards cross-selling

2. Liability transforms into an asset: Savings Account, while a source of funds, are treated as liability from an accounting standpoint. With a SaaS product and pricing, you can look at treating it as an asset

With Covid 19 and the subsequent lockdown, this would be a great time for banks to re-look at their entire savings account strategy and modernize it completely.